A growing number of identity theft victims are having thoughts of suicide, the Identity Theft Resource Center reported Wednesday.

In its annual Consumer Impact Report, the ITRC noted that 16% of victims seeking support from the organization in 2023 acknowledged they had contemplated suicide after having their identity compromised, a substantial increase compared to 2022, when 10% had such thoughts.

“We have watched that percentage grow over the years, and it has doubled in the last two years,” ITRC President and CEO Eva Velasquez told TechNewsWorld.

She noted that the suicide question has been part of the Consumer Impact Report for 20 years, and until recently, responses have hovered between 2% and 4%.

“We saw it rise to 8% in 2020 and 10% in 2021, and I thought that it was because of the pandemic, because of a ‘piling on’ effect,” she said.

“People were dealing with uncertainty and these tectonic shifts in their lives,” Velasquez continued. “When you added identity theft on top of that, people were having a stronger reaction and feeling more at a loss at how they were going to navigate this and find their way to recovering their identity.”

“But when I saw it go up to 16% in 2022 — after we were getting back to a bit more normalcy — I was stunned.”

‘Devastating Event’

Velasquez maintained that the increase in suicidal thoughts among ID theft victims speaks to today’s internet landscape and the sophistication of thieves and the inexpensive tools available to them to hone their crimes, the sheer volume of personal data and identity credentials in the wild due to data breaches, and the fact more transactions are conducted online.

“Identity theft is a devastating event where individuals are pretty helpless in their ability to address the situation,” said Guy Bauman, CMO and co-founder of IronVest, an account and identity security company in New York City.

“Often the bad news triggered by identity theft cascades and amplifies to every facet of financial life,” he told TechNewsWorld. “The stress of ‘proving’ you don’t owe money, of fixing your credit, or of recovering defrauded funds, can be simply overwhelming for many individuals.”

“Identity theft is extremely personal, leaving the victim with an overwhelming feeling of being violated,” added Timothy Morris, chief security advisor at Tanium, a maker of an endpoint management and security platform in Kirkland, Wash.

“It is an extraordinarily emotional event, even traumatic for some,” he told TechNewsWorld. “The ID theft might cause feelings of intimidation that are too hard to handle.”

Perils of Digital Personas

Identity theft today is more than a few fraudulent charges on a credit card, asserted Karen Walsh, CEO of Allegro Solutions, a cybersecurity consulting company in West Hartford, Conn.

“People’s personal lives are tied to their digital personas,” she told TechNewsWorld. “We share medical information, financial information, and personal life stories on the internet.”

She pointed out that being victimized by an identity thief can add to a feeling of hopelessness for people struggling with debt. “They’re already working tirelessly to fix their finances, and the financial losses arising from ID theft could easily feel like one more obstacle in a long line of challenges,” she said.

Roger Grimes, a defense evangelist at KnowBe4, a security awareness training provider in Clearwater, Fla., added that more than money can be lost to identity bandits.

“I’ve had many people over the years contact me to help them get their identity back for their Instagram or Facebook accounts,” he told TechNewsWorld. “They have sounded as stressed as a person could be.”

“One told me that their entire business was run from the stolen account, and if they couldn’t get it back — and they didn’t — their small business was over,” he said.

“Another told me that every picture she had of her recently deceased father was in her stolen Instagram account,” he continued, “and if I couldn’t help her get it back — I couldn’t — every picture of him would be gone.”

“Today, your online life is your real life and every stress that entails,” he noted.

Victims of Multiple Attacks

There’s no shortage of examples to demonstrate how devastating identity theft can be for victims, maintained Darren Guccione, CEO of Keeper Security, a password management and online storage company in Chicago.

“This type of crime is not only common but financial losses to fraud continue to grow across the U.S., according to data from the FTC,” he told TechNewsWorld. “Serious cases can require enormous amounts of time and money for victims to recover.”

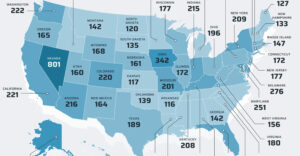

According to the Federal Trade Commission, it received 1.4 million reports of identity theft in 2021 and 1.1 million in 2022.

The ITRC report, based on interviews with 144 victims who contacted the organization for assistance in 2022 and an online survey of 1,048 consumers, also found that 41% of victims and 69% of consumers have been victims of ID theft more than once.

“I’m surprised it’s only 70% of people,” Grimes said. “I’ve had my identity stolen multiple times in a year and multiple times over multiple years, and I practice online safety with the best of them.”

“I would think that far more people have been victims of ID theft than they know,” he added. “Most people likely don’t even know when they’ve been compromised.”

Fraudster Gold Rush

Kristine Jacobson, founder and CEO of the Conveyance Marketing Group, a marketing consulting firm in Leesburg, Va., explained that cybercriminals want to make as much money as possible with as little work as possible, which is why they will continue to deploy attacks against previous victims.

“With so much automation available on the dark web, they don’t have to spend a lot of time retrying credentials,” she told TechNewsWorld.

“If a victim changes a password, the criminals don’t really lose any time or money,” she continued. “If a victim hasn’t changed a password, they get additional benefits from the stolen credentials. If they’ve purchased the credentials on the dark web, then any successful attacks beyond the first one are almost ‘freebies.'”

Another finding in the ITRC report was that more victims lost more money than in previous years. About 26% of victims reported losses exceeding US$100,000.

“The pandemic forced millions and millions of people online to do lots of different stuff, so they were sharing much more information online and with third parties,” said John Gilmore, head of research at DeleteMe, a privacy service in Boston that helps users remove their personal information from data broker websites.

“The consequence of all that sharing created a gold rush for people in the fraud industry,” he continued.

“The increase in the size of the amounts lost is a factor of the increased number of the types of financial payments,” he said. “A huge percentage of the losses to fraud in 2022 were crypto scams. The numbers associated with crypto-related fraud have inflated a lot of the damage numbers.”