The U.S. healthcare industry is in the midst of transformation, including an overhaul of its information infrastructure from physical to digital, and the rise of informed and increasingly empowered consumers. Managing consumers’ healthcare experience is no longer a selling point, but a must-deliver component of technology vendors’ solutions.

Within the connected fitness space, tech leaders in the consumer fitness and wellness segment are entering the medical devices and data market, participating in studies for clinical validation, and seeking regulatory compliance with the FDA and HIPAA.

Fitbit and Apple are leveraging their wearables platforms to develop diagnosis and monitoring algorithms.

With CareKit, Apple is enabling care providers to develop apps on its platform rather than forcing a one-size fits all solution. This allows the process to be physician-led and physician-guided.

Both Apple and Amazon are seeking to make their devices healthcare platforms for third-party medical applications.

Alongside tech giants, retail brands are incorporating connectivity into their product lines, helping to raise awareness:

- Under Armour announced a partnership with Samsung and JBL to provide a fitness ecosystem of smart shoes, watches and applications.

- Peloton emerged to revolutionize the stationary bike with a subscription model for on-demand and live streaming fitness courses — a first in connected social fitness.

The latest trends and developments in connected health include connected health and fitness devices giving consumers greater insight into health metrics, increased availability and use of telehealth services, and companies focusing on providing independent living solutions centered on smart technology.

Connected Devices

Connected health and fitness devices — particularly wearables — provide users with new insights into their own health.

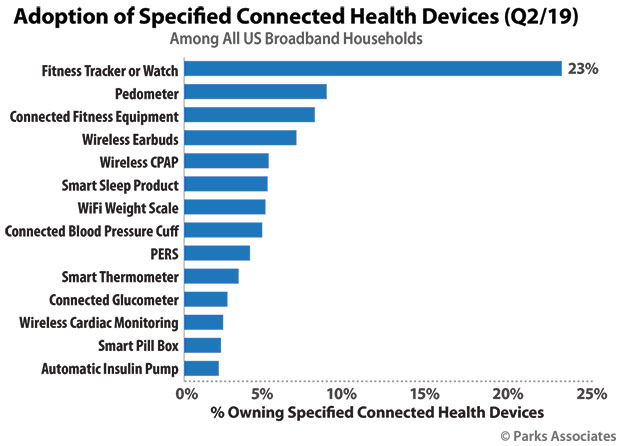

Adoption of connected health devices has been increasing over the years, and 40 percent of consumers now own at least one listed connected health device, across a variety of devices designed for wellness, fitness and medical purposes.

Wearables have been seeing tremendous growth since Parks Associates first started tracking the category in 2013. Fitness trackers or watches are reaching almost a quarter of broadband households, at an adoption rate of 23 percent.

The distinct form factors are blurring, as fitness trackers and smartwatches serve overlapping needs, and marketing messages do not draw a clear difference. Overall, smartwatches are gaining ground quickly, and one-third of smartwatch owners used a fitness tracker before buying a smartwatch.

Telemedicine and On-Demand Virtual Care Services

Telemedicine and on-demand virtual care services provide a remote solution for physician visits, transitional care after a hospital discharge, and ongoing chronic care management, which can lower costs for both patients and providers.

For example, Jefferson Health found that its telemedicine platform’s net cost savings to the patient or payer per telemedicine visit was US$19 to $121, which represents a meaningful cost savings when compared to the $49 cost of an on-demand visit.

These services also are incredibly convenient for consumers and can expand access for those who have difficulty getting to the doctor, whether due to distance, scheduling or condition.

Telemedicine provides the convenience and efficiency of not requiring the patient to physically go to a physician’s office, enabling flexibility — a key value proposition for patients.

However, physician licensing varies state-by-state, which poses a challenge for residents who do not live in the same state as their physician. Similar to licensing requirements, reimbursement varies state-by-state, by service, and third-party payer.

Potential telehealth users will have to navigate different types of telehealth and differing reimbursement policies, define originating and distant sites, and determine if they are in a health professional shortage area (HPSA), among other things.

Independent Living Solutions

Independent living solutions, which encompass a variety of assistive technologies, are extending seniors’ ability to stay in their home safely, and enhancing communications with loved ones.

Companies across the spectrum, from device manufacturers to monitoring providers, are enabling independent living solutions. American Two Way, for instance, utilizes its monitoring capabilities to provide personal emergency reporting system (PERS) and telehealth solutions. Similarly, Rapid Response provides monitoring for PERS and mPERS.

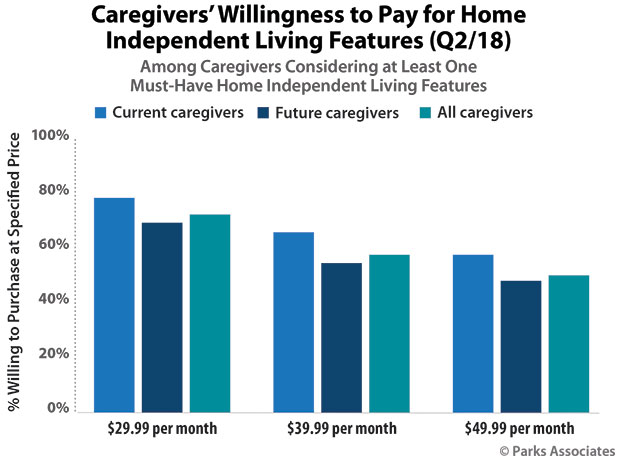

The independent living market is challenging, in that the end-user may not be the buyer of the product. Caregivers consistently show higher interest and higher willingness to pay for a solution than do seniors themselves — particularly seniors aged 75-plus who are most in need of such a system. Affordability is an issue for seniors, many of whom are on fixed incomes in retirement.

Thirty-eight percent report being “very concerned” about having sufficient financial resources as they age. The majority of interested caregivers would pay $50/month — the highest price point tested — for an independent living solution for their loved ones. Seventy-seven percent would pay $30/month — the same monthly price as Best Buy’s Assured Living solution (plus upfront equipment fees).

As we move into 2020 and beyond, expect the lines to blur across several categories in the connected health space as care providers experiment with consumer devices as part of larger remote patient monitoring programs, and consumer solutions experiment with integrating virtual care services into their offerings.