A number of firms have recently launched remote home monitoring services. Are they able to do so because of widespread broadband adoption or consumer demand?

The answer is both, but to examine this issue in more depth, we should explore both sides and see what conclusions can be drawn.

Burgeoning Broadband

First, always-on broadband Internet connections facilitate a variety of applications, including multimedia downloads, software updates and Internet telephony (VoIP). Remote home monitoring is also on that list. Consumers with broadband can connect a variety of sensors (motion, door/widow, power, water, etc.) and a camera to the Internet connection via a special gateway, standard router, or a PC, and receive system notifications or transmissions via a mobile phone, a wireless PDA, e-mail, or a private Web site.

The number of broadband households exceeded 52 million at the end of 2006 and is expected to reach to 80 million by 2010. This population is a large enough to warrant trials of many types of services, so it is not surprising to see different companies, from service providers like AT&T and Bell Canada to start-ups like iControl, uControl and WiLife, enter the market.

Broadband access is not required for all monitoring services. Eaton Electrical recently brought its Home HeartbeatTM system to market using text messaging and wireless communication technology based on the ZigBee (IEEE 802.15.4) protocol to alert users of situations in the home that may need attention — wet basement floors, open doors, lights on, etc. Other systems such as Alarm.com‘s and Bell Canada’s Home Monitoring don’t require broadband connections, but most do or have enhanced capabilities with broadband connections.

Five-Year Outlook

Clearly there is no shortage of systems and services, but will the market gain traction? First, let’s define the market we are focusing on here: remote, self-monitoring systems and services for the home. There is a well-developed market for professional monitoring services provided by ADT, Brinks, and a host of others. In addition, home health monitoring services present another market opportunity. These services, in addition to remote home control capabilities, may be combined with remote self-monitoring services for the home, but in this article we want to examine its potential on a stand-alone basis.

When looking into the face of a new market opportunity to quantify its magnitude, sometimes it’s useful to examine where people currently spend their money and if some of this spending could be diverted to an alternative. At the end of 2006 there were nearly 20 million households in the U.S. with monitored security systems, generating close to US$6 billion annually. In addition, there are about two million households with security systems installed but not monitored. Companies such as Next Alarm, uControl, and Intamac are targeting homeowners that currently have security systems in an effort to divert some of that monitoring service spending in their direction. This strategy is a reasonable approach and likely one that will bear the most fruit. Here are some of our key assumptions based on our research and analysis:

- Self-monitoring systems will appeal to some households with security systems installed.

- Five to 6 percent of households with a security system will adopt self-monitoring capability in the next 12 to 18 months; 12 to 15 percent will do so in five years.

- Not all of these households will be willing to pay for self-notification services; most will opt for free services.

- Households with no security system currently installed are less likely to adopt some form of self-monitoring capability.

- Only 0.5 to 0.6 percent will adopt in next 12 to18 months; 1 to 1.5 percent will do so in five years.

- Overall, 4 to 5 percent of households that opt for some form of self-monitoring system will pay for a notification service in the next 12 to 18 months; this will increase to 15 to 20 percent within five years.

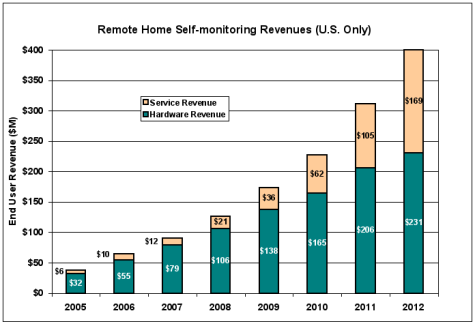

Based on these assumptions and our expectations that average self-monitoring fees per household will drop from more than $20 in 2006 to less than $14 within five years, self-monitoring service revenues will grow more than tenfold, from $11-12 million in 2007 to nearly $170 million by 2012. Self-monitoring hardware revenues will surpass those for services over the next five years because most households won’t pay for a notification service but instead opt for free, passive-monitoring capabilities. In 2007, hardware revenues will reach $80 million and grow to more than $230 million by 2012. In total, the market will more than quadruple, from under $100 million in 2007 to $400 million by 2012.

The bottom line is that a couple of million households will see the benefits of self-monitoring their homes remotely over the next 12-18 months, and these ranks will grow to six million by 2012. These numbers do not make stand-alone, mass-market opportunity in the short term, but service bundling — coupling monitoring capabilities with home control, health monitoring services, or packages of communication and content services — could spark greater consumer demand.

Examples of Remote Home Monitoring Systems and ServicesCompanyProducts/Services and CapabilitiesRecurring FeesAlarm.com

- Security and normal actively monitoring

- Communication via telemetry; X-10 interface available

- Notifications to e-mail and wireless devices

- Self-monitoring: $24.95/mo

- Prof. monitoring: $35.95/mo

- Based on Xanboo technology

- Intrusion and activity monitoring (including video)

- Lighting and appliance control

- Self-monitoring: $9.95/mo

- No prof. monitoring

- “Home Monitoring” based on Intamac technology

- Intrusion detection and activity monitoring (including video)

- Uses Bell Canada’s digital wireless network

- Self-monitoring: $19.95 to $24.95/mo

- Video: $7.95/mo

- Prof. monitoring available

- Home Heartbeat — door, power, water sensors and water shutoff

- Uses ZigBee communications protocol

- Notifications sent to Home Key or cell phone

- $29.99 for 500 alerts

- No prof. monitoring

- Intrusion detection and activity monitoring (including video)

- Notifications via e-mail and text messaging

- Control of Z-wave devices

- Self-monitoring: $14.95/mo

- No prof. monitoring

- Security and normal activity monitoring

- Alarm system required

- Text, voice and e-mail notifications; Web dash board

- Free self-monitoring

- Video monitoring: Pounds 5.00 ($9.90)/mo/camera

- Internet monitoring of existing security systems

- Notification via e-mail, SMS or automated phone

- Professional dispatch services available

- Self-monitoring: $5 (limited service: $0)

- Full dispatch service: $14.95/mo

- Links to existing alarm system; monitors activity and alarms

- Communicates status via cellular, broadband and phone

- Plans control capabilities via Z-wave and ZigBee

- BB monitoring: $24.95/mo

- Cellular: $32.95/mo

- DIY online, video surveillance cameras

- Motion alerts via e-mail and cell phone

- Video transmitted via HomePlug technology

- No monthly fee

- Multiple proprietary gateways (standalone, PC USB, PCI) connect devices to Internet

- Control interfaces for Z-wave, ZigBee and X-10 devices and IP cameras

- Also offered by Motorola as Homesite system

- Gateway retails for $200 to $250

- $10 monthly fee

Bill Ablondi is director of home systems research at Parks Associates.

The company is http://www.myatasystems.com