Maintaining and increasing research and development (R&D) spending in the COVID-19 era is critical for high technology vendors to deliver new solutions and services, continue to innovate, and position their businesses to rebound from the negative effects of the global pandemic.

COVID-19 has been disastrous for business around the globe. The novel coronavirus has disrupted and continues to upend every aspect of corporate and personal daily life. Analysts, financial advisors, and investors concur that, wherever possible, vendors should continue to aggressively invest in R&D. That is: spend money to make money.

That advice is yielding results in the form of revenue and market share gains for the biggest R&D spenders in the technology sector: Amazon, Alphabet, Apple, Huawei, Microsoft and Samsung.

“The high tech vendors whose businesses are thriving are those that have doubled down on their R&D spending like Amazon, Alphabet, Huawei, IBM, Invidia, Microsoft and Samsung, to name a few,” said Rob Enderle, principal analyst at the Enderle Group in Bend, Oregon.

Thriving vs. Surviving

Targeted R&D investments are the organization’s lifeblood. R&D can make the difference between a vendor’s ability to merely survive or thrive.

R&D also fortifies national and global economies to accelerate local, national and worldwide economic recovery. It plays a pivotal role in job creation and spurring gross domestic product (GDP) growth and it’s essential for post-pandemic economic recovery and job creation.

“R&D initiatives,” Enderle said, “are always a critical component of a company’s strategy, but particularly now while COVID-19 is spiking. The market dynamics and the economy will be very different in the post-COVID world and economy, and the smart vendors are laying the groundwork now.”

Enderle noted that high technology vendors cannot simply develop, launch and lock in new product portfolios and accompanying services “in one day.”

“Creating future products and services to address the post-pandemic world takes careful planning and serious R&D investment to gauge corporate and consumer technology and buying trends,” he explained.

High Tech Vendor 2020 R&D Spending Is Mixed

Vendors undeniably faced significant pressure to cut costs on everything from capital and operational expenditures to R&D throughout 2020 and into 2021.

The impact of COVID-19 is keenly felt in the high technology vendor sector, whose products are necessary staples of daily corporate and consumer life. Businesses across every vertical sector: banking/finance; healthcare; education; retail; transportation and utilities all rely on data and telecommunications networks (4G, 5G); mobile devices; servers, PCs, tablets and technologies like cloud computing, artificial intelligence (AI) and data analytics to power their transactions.

Since the onset of COVID-19 in early 2020, vendors from Apple to Zoom Video Communications have struggled to adjust budgets and trim expenses to minimize the impact on balance sheets, stay the course and emerge from the pandemic relevant and revitalized. COVID-19 has compelled organizations to make hard and painful cost-cutting decisions such as layoffs, furloughing workers, reducing capital and operational expenses, and reducing R&D. This is exacerbated by the uncertainty of when the global pandemic will end.

It’s no surprise that 2020 R&D expenditures among high tech were decidedly mixed. The R&D expenses of many high technology market leaders remained flat or declined slightly from previous historically high 2019 investment levels. Analysts and financial investment experts expect current R&D trends to continue throughout 2021. Ironically, just before COVID-19 ravaged the globe, R&D spending had spiked an average of five percent over the last several years, according to published studies by financial business management consultancy Bain & Company.

Investing to Win or Cutting Costs to Maintain?

Financial and industry analysts as well as watchdog groups tracking R&D expenditures and its effects on IP, patents and new products and services rollouts, all noted COVID-19’s profoundly negative impact on business operations since the beginning of the year.

A September 2020 report by Bain & Company, titled “Focusing R&D and Capex to Win,” noted that some firms are making deep cuts to R&D and capital expenditure budgets due to the “pandemic’s economic shock.”

However, the Bain & Company report also averred that “…even with budgets strained by COVID-19, industrial companies that selectively cut [expenses] and thoughtfully invest can accelerate out of the recovery.”

Similarly, a key finding of the latest 2020 Global Innovation Index (GII) report published by the World Intellectual Property Organization (WIPO) based in Geneva noted the COVID-19 pandemic “has triggered an unprecedented global economic shutdown.” The same report however, contained a sliver of good news for high technology vendors, observing that R&D spending of software and information and communication technologies (ICT) services firms are “less negatively impacted” by COVID-19 than other sectors.

The WIPO 2020 GII Index Report pegged the top global R&D spenders in software and ICT as: Google’s parent company, Alphabet (U.S.); Facebook (U.S.); Microsoft (U.S.); Oracle (U.S.); Alibaba (China); Baidu (China); Huawei (China); Tencent (China), Softbank (Japan) and Ubisoft (France). These firms, the report said, “…often hold vast cash reserves and, given the increased push to digitalization during this pandemic — namely the increase in Internet activity, cloud services, online gaming, and remote work — the revenue impact of the crisis on these firms might actually be positive.”

The Bain & Company research found that although multiple factors influence companies’ performance, “…ensuring that capital expenditure outlays and R&D continue to feed the strategic priorities of the business will have an outsized effect on which companies accelerate as winners out of the downturn and which are left behind.”

All of the financial, business and industry analysts were unanimous in their belief that high technology manufacturers should maintain and even boost R&D spending in crucial technologies like cloud, 5G and 6G telecommunications networks, security, Internet of Things, (IoT), AI, big data analytics and support services.

This year, the R&D expenditures of many high technology market leaders remained flat or declined slightly from 2019 research investment levels. There were, however, a handful of global tech titans who continue to buck the trend and aggressively increase R&D spending — both in real monies and as a higher percentage of total annual revenue. They include:

- Alphabet (Google’s parent company)

- Amazon

- Apple

- Huawei

- Microsoft

- Samsung

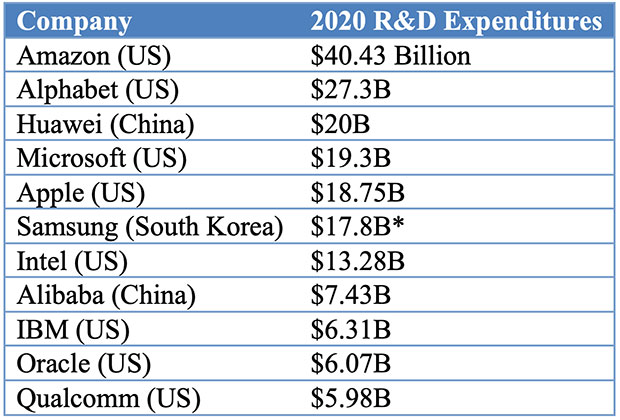

Cisco Systems, for example spent approximately US$6.35 billion on its 2020 R&D expenses. Though still robust, it’s a slight decline from the $6.58 billion it allocated in 2019. Similarly, semiconductor market leader Intel’s R&D expenses for the twelve months ended Sept. 30, 2020 also remained vigorous at $13.285 billion, though it’s a reduction of 0.94 percent year-over-year. However, to put this in perspective, Intel’s R&D expenses are more than the combined total of its two biggest competitors — AMD and Nvidia.

Software giant Oracle’s R&D expenses were up slightly in 2020, climbing to $6.07 billion from the $6.03 billion it expended during 2019.

High Tech’s Biggest R&D Spenders in 2020

In the high tech sector, to stand still is to fall behind.

Savvy R&D investments distinguish the leaders from the laggards and losers. In the high technology arena, the most significant R&D outlays range from about $5 billion to over $40 billion.

The table below depicts the top 11 R&D spenders in 2020 in the high technology data and telecommunications, connectivity, and software sectors. Seven of the 11 concerns are U.S. companies; three hail from China and the remaining firm is South Korean.

Amazon dwarfs all competitors across every vertical market segment (including high technology) with $40.43 billion spent this year on R&D, a 19.39 percent increase from the $35.93 billion it committed to R&D expenses in 2019. Google’s parent company Alphabet with $27.3 billion, and China’s Huawei with $20 billion, have both put their R&D initiatives into overdrive.

Just as important as how much money vendors devote to R&D expenses is where they invest.

The hottest market segments in 2020 and heading into 2021 and beyond are: security, cloud computing, AI, analytics, 5G and 6G and mobility.

A large portion of Microsoft’s record high $19.3 billion R&D expenses are fueling cloud and AI development. Microsoft is second among software and computer service companies worldwide in terms of R&D spend, behind only Google’s parent company Alphabet.

Meanwhile, Apple is busy developing its own chips and modems to replace Intel semiconductors and Qualcomm modems even as it continues to evolve its mobile phone technology. Like Amazon, Huawei and Microsoft, Apple’s R&D expenses hit an all-time high in 2020; the $18.75 billion it spent over the last 12 months is roughly $2.5 billion more than the $16.20 billion in 2019 total — an increase of 13.5 percent.

Samsung spent around $8.9 billion during the first half of 2020, ahead of the $8.4 billion R&D expenditure pace it recorded in 2019. This year, Samsung should top out at close to $17.8 billion; Samsung’s R&D expenses represent nearly 10 percent of its 2020 sales which fuel patent development.

Intel has invested a total Intel of $53.18 billion in R&D from 2017 through 2020. In the process it has outspent all of its rivals in the chip industry including top competitors like AMD and Nvidia. Intel R&D represents approximately 20 percent of all semiconductor R&D expenses during the last four years. Intel has also placed a greater emphasis on a long-term data centric strategy rather than solely focusing on PCs.

China Rising

China’s top high technology vendors are going all-out to solidify their leadership stake and overtake their multinational global rivals in the top market segments: telecommunications (5G and 6G), cloud, the Internet, AI and network connectivity.

The September 2020 “Top 500 Chinese Enterprises” development report found that the average R&D expenditures of Chinese companies increased for the last three consecutive years and has now hit historical highs.

China’s top 100 Internet companies have increased their investment in research and development (R&D) activities, spending over 153.9 billion Yuan ($21.85 billion) in 2019. These are the highest R&D totals to date and they represent an overall increase of 45 percent in R&D spending from 2017 through 2019. This is according to statistics published by the Internet Society of China, which is affiliated with the Ministry of Industry and Information Technology (MIIT).

Additionally, top three Chinese technology firms: Baidu, Huawei and NetEase raised their R&D spending by 23.49 percent, 15.33 percent, and 14.2 percent respectively over the past 12 months.

Huawei R&D Investments Fuel Growth

No firm epitomizes China’s global ambitions more than Huawei. In the last five years, it has more than doubled R&D expenses and is a market leader in every segment in which it plays. Huawei boosted its R&D expenses from $12 billion in 2018 to $20 billion in 2020; its research initiatives now account for approximately 20 percent of the telecommunications giant’s overall revenue.

Huawei’s spending is targeted, focused and varied with eyes on maintaining its current customer base via reliable, best-in-class products and expanding its global footprint by synthesizing AI, big data analytics and cloud computing capabilities into its key products.

The company has an impressively varied product and services portfolio. This includes: telecommunications 5G and the emerging 6G networks; mobile phones and even server hardware, where it is one of the top five players in terms of shipments.

Looking toward the post-pandemic future, Huawei envisions cutting-edge networks being bolstered by wireless AI to power and manage the data and transactions — for such uses as self-driving autonomous vehicles. Huawei also has a strong stake in server hardware via its KunLun and Fusion line of servers, which — along with IBM and Lenovo offerings, are among the top three most reliable, secure and economical platforms in the industry according to Information Technology Consulting Corp.’s (ITIC) 2020 Global Server Hardware, Server OS Reliability Survey.

In May 2019, the U.S. Department of Commerce added Huawei to its Entity List, due to spying allegations, that have yet to be proven. Since then, Huawei has been banned from purchasing component parts from U.S. manufacturers without specific U.S. government approval. Under the terms of the ban Huawei needs a U.S. government license to components from U.S. suppliers.

Such sanctions come at a high cost for Huawei, its U.S. parts suppliers and end user customers, analysts observed. Given the symbiotic nature of vendors, suppliers, business partners and customers, locking a top tier vendor out of the U.S. market is risky: everyone in the supply chain gets hurt. Huawei has been accused, but not convicted of wrongdoing.

“Huawei has the best switches and phones and excellent servers, so any customer that is looking for best in class solutions, is also harmed at takes a hit,” Enderle said. Still, the news isn’t all bad for Huawei.

“The downside [for Huawei] is the business they lost in the U.S. The upside is that Huawei has made big gains in China, other parts of the Asia/Pacific region, and is making great inroads in Central and Latin America,” Enderle noted.

Conclusions

Manage Capex and Opex Budgets with Bold R&D Investments

The COVID-19 pandemic continues to throttle the global economy. Vendors face myriad challenges to manage capital and operational expenditure costs and jumpstart revenues.

Nonetheless, R&D investments are a crucial component to future success.

A select group of large multinational technology vendors: Amazon, Alphabet, Apple, Huawei, IBM, Intel, Microsoft, Oracle and Samsung, among others continue to double down and increase their R&D expenditures in burgeoning market segments, despite the COVID-19 global pandemic.

While overall revenues may stall in the short term, these vendors are playing the long game. They are solidifying their stakes in their respective market segments; this ensures they’ll be well positioned when the COVID-19 pandemic ends and the economy rebounds.

History shows it requires cutting deeply in the right places while also investing available resources in strategic R&D, capital and operational expenditures, and mergers and acquisitions.

“Vendors shouldn’t be penny wise and pound foolish,” Enderle advised. “Now is the time to double down in R&D investments.”

Those vendors that have completed their digital transformation will be able “to put the pedal to the metal and accelerate revenue and earnings with new products and services [depsite the] COVID-19 pandemic,” Enderle suggested. “If you haven’t been investing in R&D you have no gas pedal to push.”

So basically 1984. There is no virus, its all a lie to bring in a total control grid and you think its a good thing?