Intel announced its second-quarter 2023 financial results on July 27. After two quarters of reported losses, we now see profits, and AMD’s financials indicate that its inroads into Intel’s base may be slowing as Intel puts up more of a fight.

Intel was the clear market leader in the processor space for the entire history of the PC. As is often the case with dominant companies, its fall from that leadership position came from internal decisions made by a CEO who has since departed and a board that has been replaced.

Intel is unique in the industry not just because it was an early leader but because it retained manufacturing capabilities that allowed the business to initially weather the pandemic relatively well since it didn’t have many of the supply problems some of its fabless peers enjoyed. However, given that other parts in products Intel built were constrained, this advantage was somewhat offset by shortages in other components.

Let’s talk about Intel’s recovery this week, and we will close with my Product of the Week: Intel’s ARC GPU, the A770, which you might want to consider if you are building a showcase PC like I just completed.

Intel’s Importance

Given the current uncertainty in world politics, Intel’s current importance is less as a microprocessor company than as a microprocessor manufacturer.

Much of the world’s microprocessor capacity is in Taiwan, which is currently at risk of being attacked and destroyed by China. In a war, the ability to build advanced weaponry will be directly tied to manufacturing capacity that would be lost in the early days of the conflict, either due to destruction or blockade.

While additional manufacturing capacity exists in other parts of the world, it would not be sufficient to make up for what might be lost in Taiwan. In a large-scale war like the one with China is likely to become, moving parts internationally would be difficult. China has been aggressively buying or locking up some of these additional resources so that only domestic manufacturing capacity can provide what’s needed to execute that war successfully.

Intel’s laser focus on creating the Chips Act to build up manufacturing capacity in the U.S. would be critical to the U.S. surviving future pandemics and wars, particularly a war with China, making the company a strategic asset to the U.S. that would need to be protected.

Further, Intel does most of the work to defend x86 from competing technologies like ARM, though ARM’s recent moves make it less desirable than it once was. That technology remains a foreign threat to the dominant position of the U.S. in microprocessors. Intel also carries most of the load for building and retaining developer support for x86. Should it fail, it would be tough for the x86 platform, which remains dominant in PCs, workstations, and servers.

In short, ensuring Intel survives is critical to the U.S. and Western countries with significant investments in x86 technology. As good as AMD is, it doesn’t yet have the scope to displace Intel.

Turning a Company Around

Corporate turnarounds aren’t easy, and this is a fact well-known to Intel’s CEO Pat Gelsinger, who is now on his second major turnaround effort, having successfully revived VMware before returning to Intel. The situation with Intel, however, is far more complex. When Gelsinger took over VMware, the company was merely underperforming.

In contrast, when Gelsinger took the helm, Intel faced a more dire situation. The company’s difficulties stemmed from a series of bad decisions that preceded both Gelsinger and his immediate predecessor, Bob Swan, who had performed admirably as CEO despite his background as CFO. As a financial expert, he was unqualified to run Intel, though he guided the company as best he could.

At Intel, Gelsinger stepped into a mess of underfunded critical projects, alienated employees, and a firm that was in a self-directed death spiral. Intel’s turnaround is not over, and it was not without some mistakes, like laying off employees and reducing the remaining employees’ compensation. These decisions can turn employees against management, leading to unplanned turnover and fostering a climate of resentment, both of which can be company killers.

Still, Intel employees stepped up and brought in a decent quarter that provides a foundation for hope that Intel is now out of the weeds and will continue to improve even before its new manufacturing capabilities come online.

Intel’s Competition

Intel has three primary competitors: AMD, Nvidia, and Qualcomm. Both AMD and Nvidia have been running like tops of late with no visible mistakes, and Nvidia has displaced Intel as the company to watch in Intel’s space as it leverages its GPU capabilities because its attempt to buy ARM and gain a solid CPU presence failed.

Qualcomm has had its own issues with customers (Apple) working to put it out of business and its lack of a true PC solution, something that it should correct next year by increasing the competitive pressure on Intel.

Nvidia is the biggest near-term problem for Intel because AI is driving the market right now, and Nvidia owns AI, which has driven the company to almost unheard-of valuations. To counter, Intel needs a much stronger position in AI, robotics, and autonomous machines, including vehicles. This AI war will define the competitive landscape, and Nvidia will be difficult to catch from behind.

Intel’s recent financial results suggest that it will put up a far better fight going forward. However, unless Nvidia stumbles as Intel did, catching that company from behind will be extremely difficult.

Wrapping Up

Intel’s Q2 financial results provide a powerful argument that the company is coming back and should give the OEMs some confidence that Intel can deliver.

Its AI-focused parts will show up in full force next year with some products that look competitive on paper and should be a game-changer if the company continues to execute as it is now. Still, it will face the next-generation parts from all the competitors at that time. No one is sitting out this fight, which will likely be ugly.

It is by no means certain who will win the AI wars. Until these recent financials, I worried that Intel was overmatched, but it’s becoming organized and will now make this a fair fight. Nvidia has a huge lead right now, but AI isn’t mature yet, which means we will likely see many leadership changes until it is. Those changes now have at least a chance of returning Intel to its former glory.

Praise is due to the Intel employees who stepped up during a challenging time to secure a critical quarterly win for the company while facing layoffs and income reduction. After these hardships, I initially expected a death spiral at the company. However, it now appears to be well on the path to recovery.

Intel ARC A770 GPU

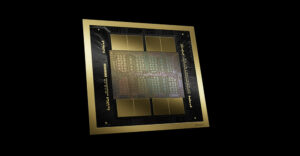

Before the end of last year, Intel sent me two of its new graphics cards to test: an A770 and an A750. Until now, I couldn’t get them to work. Intel stopped sending out desktop review systems or parts some time ago, so most of us now test on AMD-based systems. Unfortunately, these Intel graphics cards don’t like the new AMD systems.

Don’t even consider one of these cards if you have an AMD-based desktop PC. But, on an Intel box, the cards’ performance was impressive, and they tested on 3DMark better than similarly priced cards from AMD and Nvidia.

The two cards were very close in performance, leading me to conclude that the reason you might pick one over the other would be for appearance more than performance. The A770 lights up in a pleasing blue. The card is showcased very nicely in a GPU display case, as shown here:

Intel ARC A770 Graphics Card (Photo by Author)

It is interesting to note that while prior cards from AMD and Nvidia used to light up nicely, they don’t anymore because, in a typical case where the card mounts flat on the side, you really can’t see the lights. But in a GPU card display case, the lighted fans and features really make the card pop.

In my testing using 3DMark, the Intel ARC A770 ($438) performed in line with Nvidia’s new 4060 Ti ($399) and outperformed AMD’s new Radeon 7600 ($269) on the Intel test system.

There was not a significant difference in performance between the A750 and the A770, so if you don’t need the lighting (and I wish Intel had used a common lighting interface), go for the A750, which is priced closer to the Radeon 7600 and about $200 less than the 4060 Ti.

Intel recently discontinued the A770, but it is still available at Amazon. I also found the Predator BiFrost A770 for $340, and it did an even better job with the lighting, and there is the Intel A750 for as little as $219, which is impressive and is maybe the best deal of the bunch. All of these are on Amazon, but the prices are changing, so shop around.

By the way, I built three systems over the last couple of weeks, two AMD and one Intel, and have fallen in love with the HYTE Y60 GPU display computer case. It is an easy case to work on, looks good when completed, and exhibits your GPU like it is the star of the show, which it kind of is these days.

I’m also using the ID-Cooling Zoomflow 240X ARGB CPU water cooler, which for $70 is one heck of a cooler, and you can adjust the lighting with your motherboard lighting controls. I generally favor MSI motherboards for ease of use, as well. I tend to build new PCs during the summer, and there is nothing like a custom-built, lighted PC that you have created yourself to give folks pause when they see your office.

During this latest round of testing, I was impressed that all the cards were extremely quiet, but if appearance is critical, in a GPU display case, the Intel A770 was the best looking by far and worth consideration which is why it is my Product of the Week.

You could also consider buying the Predator BiFrost version of the card because it looks even better and costs much less.