Hewlett-Packard, like other leading server vendors IBM and Dell, sees a server future that is thin, cool and efficient as the blade server market continues to grow at a steady pace.

Thanks to cost-savings, scalability and manageability, thin blade servers are appealing not only to typical, larger high-performance computing (HPC) customers but to small and medium-sized businesses (SMBs) as well.

With the cost savings and flexibility they afford organizations of all sizes, as well as increased competition among leaders IBM and HP and more from Dell and Sun, the blade server market is indeed advancing rapidly, IDC Research Vice President Jean Bozman told TechNewsWorld.

“We think the [blade server] market by 2008 will have more than doubled from what it is today,” she said, referring to a blade server market worth US$2.1 billion in 2005 that should to reach to $6 billion by 2008.

Power and Cooling

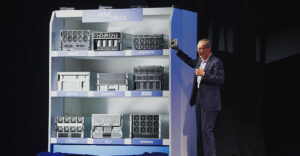

Blade servers, thin enterprise computers that are stacked in appliance-sized racks or chassis, are part of a trend toward cooler, more power-efficient computing exemplified by the latest processors and servers.

HP last month introduced its speedy HP BladeSystem c-Class, which includes interconnect technology from Mellanox and Voltair, two members of HP’s BladeSystem Solution Builder program.

“Blade server adoption will continue to accelerate over the next several years, fueled by higher performance and greater flexibility at lower costs,” said HP High Performance Computing Division Vice President and General Manager Winston Prather.

Differentiating Design

Blade servers have the potential to reach smaller and particularly medium-sized businesses, provided third-party vendors help those organizations better utilize blades, IDC’s Bozman said.

She reported that blades represented about 5 percent of the overall server market worth about $12 billion during the first quarter of 2006.

Led by IBM, followed closely by HP with Dell trailing in third, the technology in the blade server market is composed of the same basics, but is differentiated by server racks and support, according to Bozman.

“Even though a lot of blades are based on the same standard parts and components, there are differences in chassis and in the ecosystems around the blades, such as suppliers,” she said.

Blade Race

The componentized nature of blade server infrastructures allows IT organizations to more efficiently manage not only servers, but also the power, cooling and support costs that go along with server systems, Interarbor Solutions Founder and Principal Analyst Dana Gardner told TechNewsWorld.

The analyst predicted fierce competition, along with increased flexibility for customers, from the top server vendors as they fight it out on blades.

“There’s going to be an ongoing race of datacenter total cost of ownership story and there’s also going to be the fact that beyond the benefit of money is the issue of agility,” Gardner said.